USD to INR: Current Exchange Rate, Conversion, and Insights

The USD to INR exchange rate is one of the most widely followed currency pairs in the world. It represents how many Indian Rupees (INR) one can receive for one United States Dollar (USD). Whether you are planning international travel, sending remittances, or trading forex, understanding USD to INR trends and conversions is crucial.

What is USD to INR?

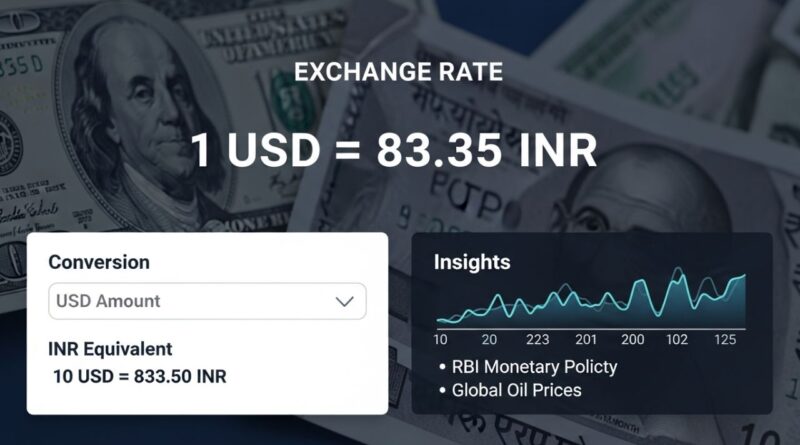

USD to INR refers to the value of the United States Dollar expressed in Indian Rupees. It is influenced by multiple factors including international trade, economic growth, interest rates, inflation, and government policies in both countries. For example, if the USD to INR rate is 83.50, it means 1 USD equals 83.50 INR.

How to Convert USD to INR

Using Online Calculators

The easiest way to convert USD to INR is through online currency converters. Simply enter the amount in USD and the tool automatically calculates the equivalent in INR based on the latest exchange rate.

Manual Conversion Formula

To manually convert USD to INR, use the formula:

Amount in INR=Amount in USD×Current USD to INR rate\text{Amount in INR} = \text{Amount in USD} \times \text{Current USD to INR rate}

Example: If you have 100 USD and the current rate is 83.50, then:

100×83.50=8,350INR100 \times 83.50 = 8,350 INR

Factors Affecting USD to INR Exchange Rate

1. Economic Performance

A strong U.S. economy often strengthens the USD, impacting the USD to INR rate. Conversely, economic growth in India can influence the Rupee’s value.

2. Interest Rates

Interest rate changes by the Federal Reserve (U.S.) or Reserve Bank of India (RBI) can shift currency values. Higher U.S. rates usually boost the USD against the INR.

3. Trade Balance

India’s import-export balance affects demand for foreign currency. Large imports increase the demand for USD, which can lead to a higher USD to INR rate.

4. Inflation

Inflation differences between the U.S. and India can impact purchasing power parity, thereby affecting exchange rates.

USD to INR Trends

Historically, the USD to INR rate has shown a steady upward trend over the past two decades, indicating a weakening Rupee relative to the Dollar. Traders often analyze long-term trends to make predictions, while travelers and businesses monitor daily rates to optimize transactions.

How to Get the Best USD to INR Rates

-

Banks and Forex Services: Check multiple banks and authorized forex providers for competitive rates.

-

Timing Transfers: Exchange rates fluctuate daily; monitor rates to convert at favorable times.

-

Digital Platforms: Platforms like Wise, Remitly, and PayPal offer transparent conversion rates and lower fees.

-

Avoid Airport Currency Exchange: Airport kiosks often offer lower conversion rates compared to banks or online platforms.

Practical Uses of USD to INR Conversion

-

Traveling: Helps budget for hotel, food, and transport expenses in India.

-

Remittances: Overseas Indians sending money home rely on real-time USD to INR rates to maximize value.

-

Business Payments: Companies importing goods from the U.S. or making dollar-denominated payments monitor USD to INR closely.

-

Investments: Forex traders, stock market investors, and mutual fund managers analyze USD to INR for hedging and profit opportunities.

Tips for Monitoring USD to INR

-

Use reliable finance websites or apps to track live rates.

-

Set alerts for target rates if planning large transactions.

-

Consider fees and charges in addition to the raw conversion rate.

Conclusion

The USD to INR exchange rate plays a vital role in personal finance, business, and international trade. Understanding how it works, the factors influencing it, and the best ways to convert dollars to rupees can help individuals and businesses make informed financial decisions. Regularly monitoring the USD to INR rate ensures you get the most value whether you are traveling, sending money, or investing.